THE CASE AGAINST

THE UP-NS MERGER

Mega-Merger Threatens Freight Competition,

Customer Choice, and Supply Chain Stability

- The U.S. supply chain thrives on choice, innovation, and resilience. A merger that reduces competition introduces risks and limits flexibility – especially given the challenges seen in past integrations.

- The proposed UP-NS merger isn't being driven by customer needs – it's being driven by short-term financial interests. BNSF believes there's a better way: delivering real, immediate benefits to customers while maintaining a healthy competitive landscape.

Preserve Rail Competition: A Better Path Forward for Customers and the U.S. Economy

HAVE YOUR SAY!

Your Voice Matters

- We encourage you to participate in the STB review process and share your perspective.

- Let regulators know that preserving competition and customer choice is essential for a healthy supply chain and economy.

PRESERVE COMPETITION

BNSF Advantage – Our Commitment to Compete

- BNSF believes in collaboration – not consolidation – to expand service and preserve a balanced, customer-focused network

- Learn more about our customer-first approach powered by industry-leading innovation, strategic investments, and collaborative partnerships – delivering reliable, efficient, and resilient supply chain solutions that help your business win.

Protecting Customer Choice and Market Balance

- The proposed UP-NS merger would concentrate nearly half of the nation's freight under one railroad – limiting shipper choices and reducing long-term competitiveness.

- Unlike the CP-KCS merger (which affected just 5% of the market), this proposal is unprecedented in scale and could reshape the industry in ways that limit customer options.

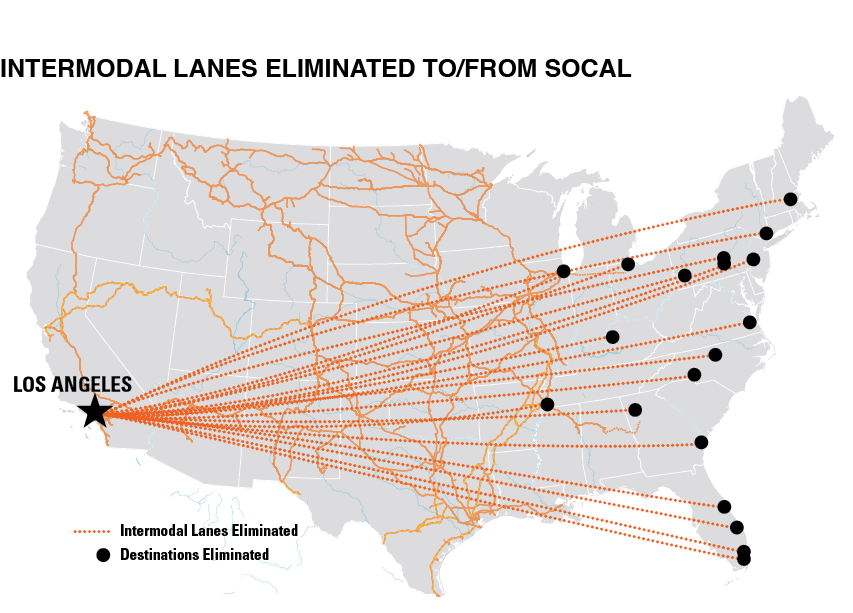

- Eliminating up to 300 intermodal lanes and closing facilities could permanently reduce access and flexibility for shippers and the consumer goods our country depends on.

Why Competition Drives Better Service and Pricing

- Healthy competition drives better service, fair pricing, and continued infrastructure investment – all of which are at risk under a mega-merger.

- Customers with limited shipping alternatives – especially in chemicals, agriculture, and metals – would likely face higher rates and reduced service reliability.

- Efficiency promises often fall short; when targets aren't met, rate increases and cost-cutting measures follow, affecting reliability and customer experience.

PROTECT THE SUPPLY CHAIN

Safeguarding Supply Chain Resilience and Economic Stability

- The pandemic underscored the need for a resilient supply chain—this merger introduces significant risk to that stability.

- Past mergers have led to service disruptions that took years to resolve. Even smaller integrations have caused ripple effects across the economy.

For example, after the UP-SP merger in 1996, the initial congestion in Houston created a domino effect, with rail traffic backing up for thousands of miles across the country. By the fall of 1997, the system was completely paralyzed:

Massive delays

Average train speeds plummeted, and tens of thousands of rail cars were left stranded on sidings for weeks or months.

Economic disruption

Major industries, particularly the chemical and agriculture sectors, were severely impacted. Factories in the Gulf Coast region were forced to shut down due to shortages of raw materials, and ports in California saw massive backlogs of cargo.

Financial fallout

Shippers lost an estimated $100 million per month from delays. Union Pacific itself lost more than $1 billion and experienced three consecutive quarters of net losses. Several major companies sued the railroad.

Enforcement of merger conditions has proven challenging and ineffective despite regulatory safeguards.

- BNSF has pursued legal action repeatedly over 24 years to enforce UP/SP merger access rights.

- 69 of 200 requests delayed or denied since the merger: often resulting in lost opportunity to service options for shippers.

- Even when granted, delays often stretch for months or years, eliminating real competition.

- BNSF has prevailed in 70% of the cases that had to be brought before the STB demonstrating that BNSF was not asking for more than what was granted in the original merger concessions.

STAY INFORMED

- Jan 20, 2026 Customer Letter from CMO Tom Williams

- Jan 6, 2026 Customer Letter from CMO Tom Williams

- Dec 19, 2025 Statement from CEO Katie Farmer

- Dec 19, 2025 Customer Letter from CMO Tom Williams

- BNSF Flyer | The UP-NS Merger: A Monopoly in the Making

- Sep 29, 2025 Customer Letter from CMO Tom Williams

- Nov 12, 2025 Customer Letter from CMO Tom Williams

- Nov 12, 2025 Statement from CEO Katie Farmer

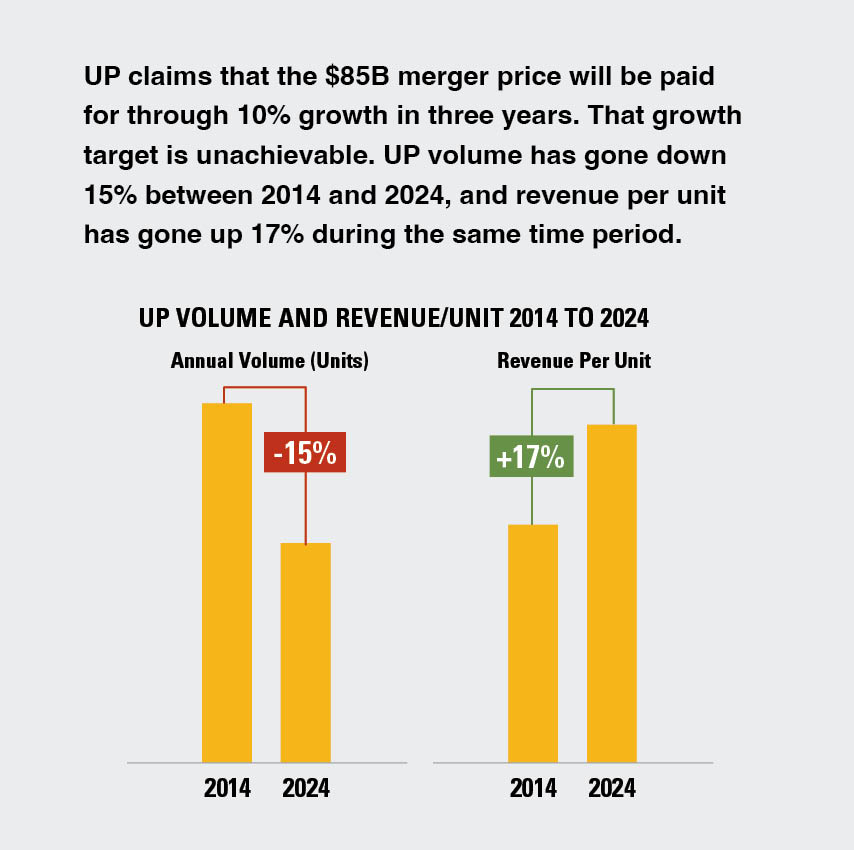

- Feb 9, 2025 | The FreightFA Brief | The ‘Mathematical Impossibility’ Behind the UP–NS Merger

- Feb 3, 2025 | Montana Talks | BNSF Warns Montanans About Proposed UP-NS Railroad Merger

- Jan 29, 2025 | Hawkeye Reporter | Iowa Secretary leads call for scrutiny of major railroad merger affecting agriculture

- Jan 27, 2025 | TRAINSPRO | Seven Chicago-area suburbs join forces to address UP-NS merger

- Jan 26, 2025 | St. Louis Magazine | St. Louis looms large in Union Pacific, Norfolk Southern merger

- Jan 19, 2025 | Cowboy State Daily | Feds Reject Railroad Mega Merger That Threatened Wyoming Coal

- Jan 17, 2025 | TRAINSPRO | Two shipper groups voice support for STB decision on UP-NS merger application

- Jan 15, 2025 | Bloomberg | Berkshire-backed BNSF says rail megamerger risks price rises

- Jan 14, 2025 | TRAINSPRO | Farmer reiterates that BNSF has ‘no interest’ in merger

- Jan 12, 2025 | TRAINSPRO | BNSF and CN ask STB to force UP and NS to produce more merger documents

- Jan 9, 2025 | The Atlanta Journal-Constitution | Rivals call Norfolk Southern merger ‘anti-competitive’

- Dec 12, 2025 | RAILWAY AGE | Is a UP-NS 'Fix' In? Don't Bet On It!

- Dec 12, 2025 | RAILWAY AGE | Is a UP-NS 'Fix' In? Don't Bet On It!

- Dec 9, 2025 | FORT WORTH STAR-TELEGRAM | Fort Worth-based BNSF Railway's fight against $85B merger: Are jobs on the line?

- Dec 9, 2025 | YELLOWHAMMER | Opinion: Southern ports keep America moving. Don't let a rail merger slow Alabama down

- Dec 2, 2025 | TRAINSPRO | Creel warns UP-NS merger is no 'fait accompli'

- Dec 2, 2025 | FREIGHTWAVES | Ports warn intermodal in the crosshairs of rail merger

- Dec 1, 2025 | RAILWAY AGE | BNSF to STB: First Cure UP's 'Old Harms'

- CN | Keeping Competition on Track

- CPKC | Further Rail Consolidation Not Necessary

- ACC | Rail Merger Policy: Competition and Service Reliability

- RCC | Risky Union Pacific–Norfolk Southern Merger Threatens Rail Competition and Service

- Nov 24, 2025 Trade Associations Letter to STB on Proposed Merger

- FREIGHTWAVES | Shippers Line Up Against Railroad Mergers

- FREIGHTWAVES | Rail Merger Warning: Higher Costs, Worse Service

- SUPPLYCHAINDIVE | The Wrong Track: Why the STB Should Reject Rail's Latest Power Grab

- Reuters | Rail Customers Urge Regulators to Block Union Pacific-Norfolk Southern Deal, FT Reports

- American Economic Liberties Project | The New Railroad Barons: Why the Union Pacific/Norfolk Southern Railroad Merger Must Be Blocked